The project

ARG

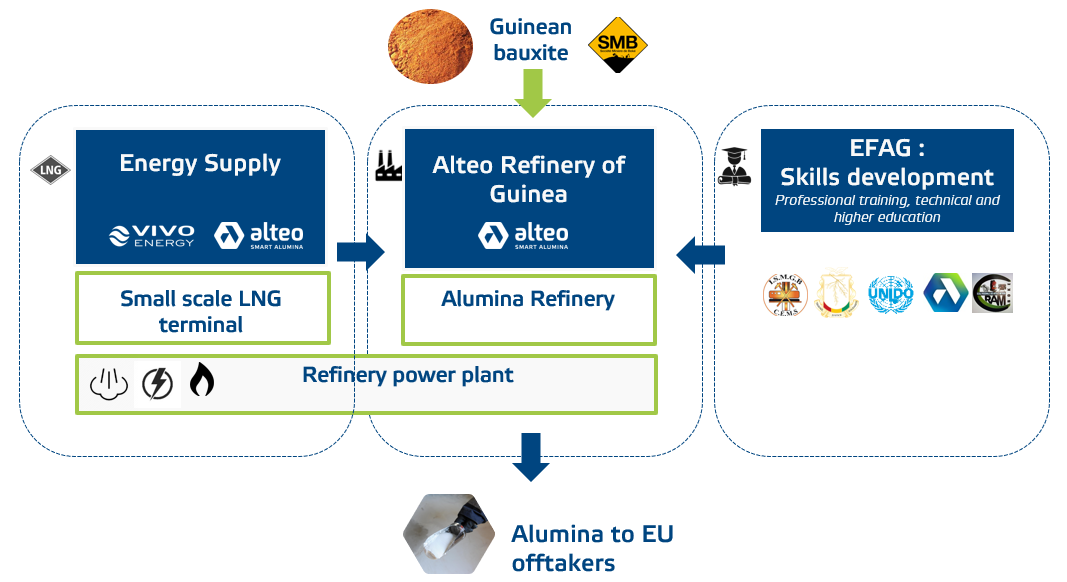

Alteo Refinery Guinea is the result of the combined know-how of Alteo, a world pioneer in the manufacture of alumina from bauxite, and UMSI, an expert in mining operations in West Africa and a major promoter of Guinea’s economic development.

Alteo Refinery Guinea was created on September 12th, 2022 to support the project to build an alumina refinery in Guinea, the first in over 60 years.

A high-value creation project in Guinea

Pioneering the first new generation refinery project in West Africa for European manufacturers, with a reduced carbon footprint and a focus on environmental issues based on the most advanced standards and technologies to date.

The project’s full implementation is expected to increase the country’s GDP by 3%, with the potential to double that figure in the second phase. The project will also contribute to the Guinean budget through the activities and benefits generated.

In addition, this project is the ideal off-taker (consumer profile and granted volumes) for energy projects especially hydroelectricity.

The project will also lead to the creation of a new industrial ecosystem around the refinery offering higher-value jobs compared to mining activities for the local communities.

With this refinery, Alteo is not only contributing to Guinea’s industrial transformation, but also to the development of a sustainable and inclusive economy.

Upgraded CSR standard & CO2 reduction project

As a responsible and committed stakeholder, we actively engage at both local and national levels, aligning our actions with the specificities of Guinea, and implementing a strategy that prioritizes the maximization of local content.

In response to the growing need of a decarbonated industry, both GHG / CO2 content (primary energy and process efficiency) as well as mitigating the impact on the local environment (water balance and waste management) will be driving the project development.

Valorizing Guinean bauxite

This project places Guinea in the exclusive club of alumina refining countries, thus valuating its bauxite resources instead of exporting raw materials.

Over 850 people, primarily in high-skilled positions, will be trained to operate the plant, including in essential maintenance roles.

The project will leverage the extensive experience and expertise of Atleo’s teams, gained from managing the Mange-garri site for over 100 years, during which they have successfully navigated regulatory changes and major developments.

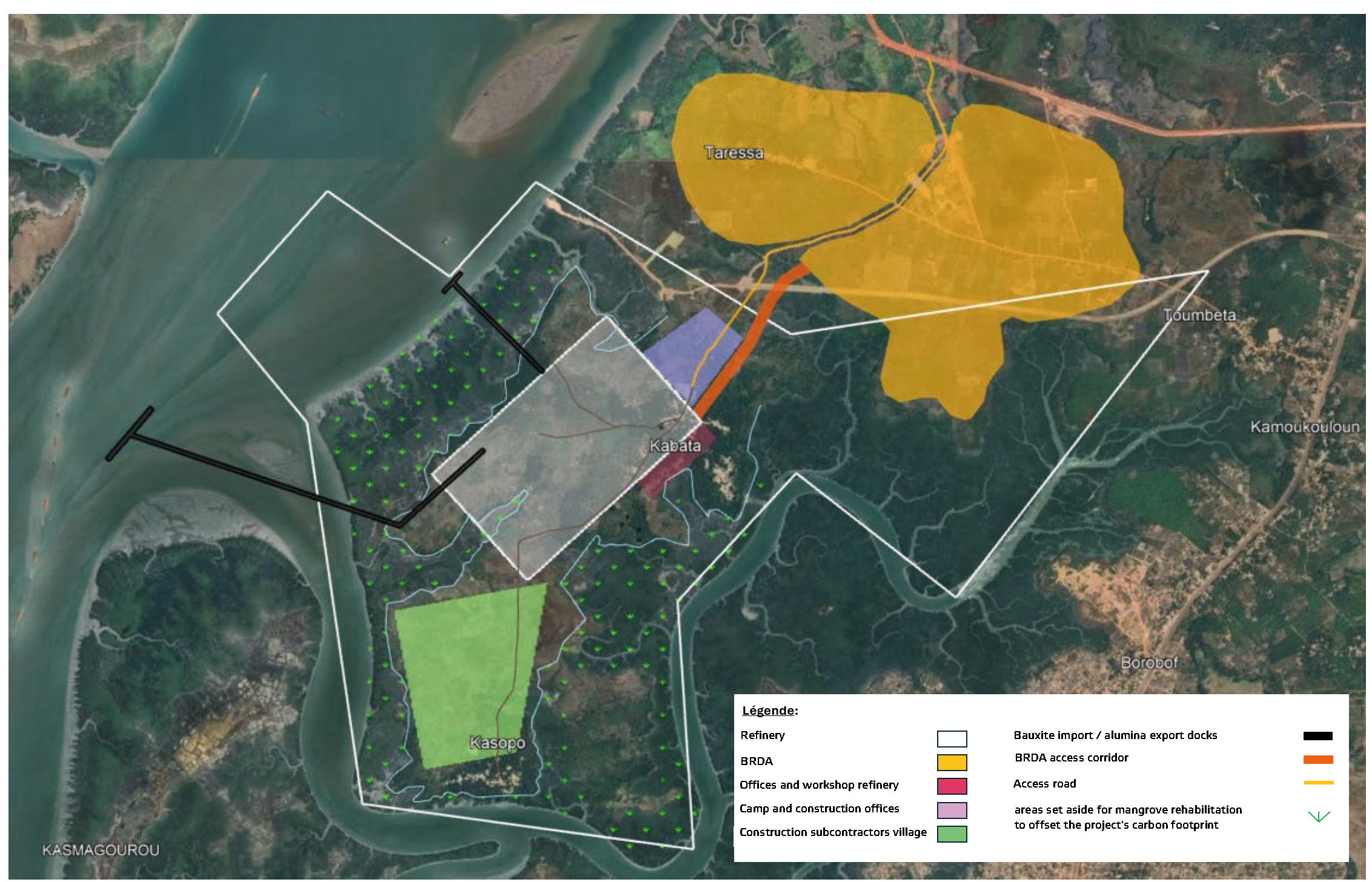

The selected Kabata site has the capacity to accommodate up to two refinery units, each with a processing capacity of over 1.2 million tons per year.

LOCATION

Source : Google Earth

THE REFINERY

The selected site is in the Kabata / Kasopo area, located on the Rio Nunes, just north of the city of Kamsar and the river’s mouth.

The site is directly connected to our bauxite river port of Katougouma, the terminal for our AMC mine dedicated to the refinery (6 hours by barge).

The project has secured a large area, through a lease signed in november 2023 and has the national recognition of the “Project of National Interest” (PIN) status, granted by the Government on 03/21/2024,

The location, outside the Kamsar agglomeration and located on a peninsula with a particularly favorable site and characteristics, allows the realization of additional stages.

A comprehensive project with three interdependent components to create a processing industry in Guinea

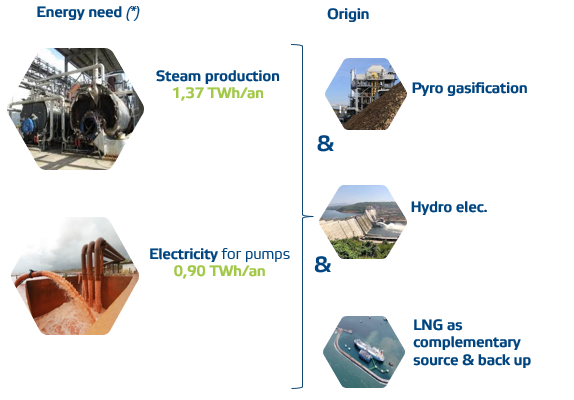

ENERGY

Description

- A credible and feasible source of energy for steam production, based on RDF & biomass, carbon neutral source of energy.

- Structured around a complete value chain that includes the collection of waste, including biomass, in Guinea.

- Local availability currently limited.

- However, a connection to the grid will be engineered during the first stage of the project.

- The project is an ideal investment (regularity and quantities), capable of bringing dam projects to bankable status (in a country with significant national potential).

- LNG is there to secure the low-risk scenario, with gas as a transitional energy source.

- The regasification and storage unit will be designed to secure the project (back up option and complementary energy source) when renewable energies will not be sufficient.

- Calcination technologies, due to the SGA quality requirement (EU market), require a certain flame purity only available with CH4.

- LNG will be gradually replaced by green hydrogen, depending on availability in the region.

PROGRAM

PROJECT PROGRAM

The years 2024 and 2025 will be devoted to banking feasibility and environmental and social impact studies. Construction work will then begin, lasting two and a half years. First production is scheduled for 2028.

THEY SUPPORT THE PROJECT

OUR PARTNERS AND PROVIDERS

MARKETS

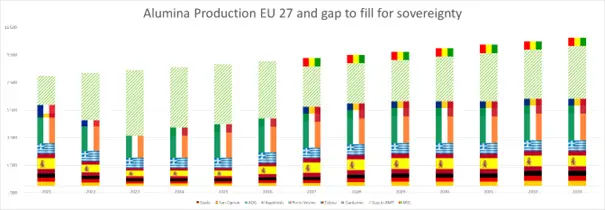

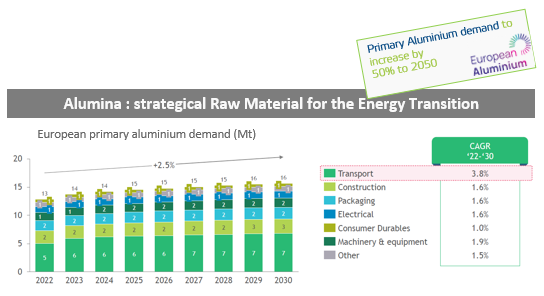

Alumina: a strategic raw material for the energy transition in a short market in the Atlantic region.

ARG is dedicated to the European market and is part of the CRMA framework (Critical Raw Material Act) & France 2030.

The ARG project is aiming at providing all the non-integrated actors of the aluminium industry and specialty alumina in Europe and in the Atlantic region.

ARG offers products meeting required strandards, competitive and with a low carbon footprint, compared to its competitors.

Within its first stage, ARG will produce the equivalent of 9% of the European Union needs, reducing its structural and growing dependency of the Atlantic region and Europe most particularly.

Sources : ARG, BCG

European refineries (excluding Russia and 100% integrated) are indeed in a difficult situation for the following reasons:

- Historical factor, because the market has been dominated by vertically integrated structures for long, capturing the value in the downstream part of the chain; the profitability of these plants is therefore historically low in relation to the capital invested,

- Cyclical and societal factors, due to inflation and energy costs (which have been poorly reflected in the LME changes), as well as the environment pressure (CO2 emissions and issues surrounding the BRDA).

This project belongs to a tight and structurally deficient market situation in the entire Atlantic area with challenges particularly in Europe, responding to the issues and risks facing European sovereignty:

- Supply security risk: the aluminum supply chain was added to the Critical Raw Materials Act (CRMA) this summer, but many imports carry a high geopolitical risk (e.g., Russia).

- The expected growing demand from China and India will reduce significantly the share of alumina exports from the Pacific to the Atlantic. Consequently, the shortage will be more pronounced in Atlantic regions.

- Carbon leakage risk: imports bear the risk of carbon leakage as they are often more emissions-intensive than European production.

Sources : BCG, European green aluminium summit 2023

ARG will produce 2 types of alumina :

- Smelter Grade Alumina SGA, 94% of the market, 10Mtpa in EU / and 125 Mtpa worldwide,

- Chemical Grade Alumina CGA (ATH+LSA+NMGA), 6% of the global demand and 12% of the global demand in EU (EU 2Mtpa / and 10 Mtpa worldwide).

Apart from primary aluminum, specialty alumina are used in more than 70 different applications : thermal management, battery separator coating, advanced ceramics, refractories, flame retardant, etc. It is a strategic input part of the CRMA since October 2023.

Alumina needs are directly linked to the development of markets driven by the energy transition:

- Transport sector growth driven by rapid adoption of electric vehicles andlightweighting needs in automotive,

- Construction and electrical sector growth reflect government investment and decarbonization policies.

OUR PRODUCTS

SGA : Smelter Grade Alumina

Smelter Grade Alumina (SGA) is the alumina used as a raw material for the production of primary aluminum. Its quality must meet strict international standards, particularly regarding particle size distribution, specific surface area, and impurity levels — especially for elements such as iron, silica, and lime.

To ensure such high quality, the ARG plant will implement some of the most robust and proven processes in the industry within its Bayer circuit. This includes high-solids desilication, next-generation filtration technologies, dual cyclone classification, and the most efficient and least abrasive calcination technology available.

LSA : Low Surface area

This is a specific type of alumina used as a precursor in the production of specialty aluminas, particularly for tubular and refractory applications.

This grade requires very specific calcination conditions, demanding precise adjustment of the process parameters.

ATH : Alumina trihydrate or aluminum hydroxide

This product will be primarily supplied to ALTEO’s Gardanne plant as a precursor for the production of its specialty alumina.

Ensuring the quality of this precursor will enable the Gardanne plant to maintain consistent quality and high performance in its final products.

Gallium

The European Union’s roadmap for a successful energy transition in 2050 recognizes the importance of gallium to provide the technological solutions of tomorrow in order to achieve this challenge. In a context of increasing geopolitical and economic tensions, China has stopped exporting its gallium since July 2023 to the European Union, which could seriously impact its ambitions.

As a reminder, Gallium is an essential element of microcomponents and in particular in the manufacture of semiconductor materials; despite its low proportion in components, it is present everywhere: Its use applies to the entire electronic consumer goods industry.

Gallium is present in favourable proportions in Guinean bauxite. Since its production is based on a Bayer process, the ARG project therefore has an additional gallium production block (3N to 4N). The natural concentration of gallium makes it possible to produce 20 to 25t per year, on stage 1 alone of the ARG project.

Such an initiative is inspired by the historical expertise of Pechiney (site of Gardanne) which, associated with Rhône Poulenc, has already implemented a process of extraction of gallium from bauxite until the late 1980s. Although this collaboration has ceased due to economic constraints, notably due to the Chinese competition, it is now industrially and strategically possible to revitalize this production sector.